Frequent errors are a common problem faced by many traders in futures trading. These errors may not only lead to financial losses, but also have a negative impact on the psychological state of traders. Understanding the causes of these errors and taking corresponding preventive measures is the key to improving transaction efficiency and success rate.

1. Lack of systematic trading plan

Many traders lack clear trading plans when entering the market, which makes them prone to making impulsive decisions when facing market fluctuations. A comprehensive trading plan should include entry points, stop loss points, take profit points, and fund management strategies. By developing and strictly adhering to trading plans, it is possible to effectively reduce erroneous decisions caused by emotional fluctuations.

2. Over trading

Overtrading refers to traders engaging in excessive trading in a short period of time, typically driven by overconfidence or anxiety about market trends. Excessive trading not only increases trading costs, but may also lead traders to overlook long-term market trends. To avoid excessive trading, traders should set a daily or weekly trading limit and strictly adhere to it.

3. Neglecting risk management

Risk management is a crucial aspect of futures trading. Neglecting risk management may lead traders to take on excessive risks in a single transaction, resulting in significant losses under unfavorable market conditions. Traders should set a risk limit for each transaction, usually not exceeding 2% of the total funds. In addition, using stop loss orders is also an effective means of controlling risk.

4. Lack of market analysis ability

Market analysis ability is one of the core competencies of futures traders. Lack of in-depth analysis of market fundamentals and technical aspects may lead traders to make incorrect judgments. Traders should regularly learn and update their market analysis skills, including technical analysis, fundamental analysis, and sentiment analysis.

5. Emotional trading

Emotional trading refers to traders being influenced by emotions such as greed, fear, and anxiety during the trading process, leading to irrational decisions. Emotional trading is one of the main reasons for trading errors. Traders should manage emotional fluctuations in trading through psychological training and self-control techniques such as meditation and deep breathing.

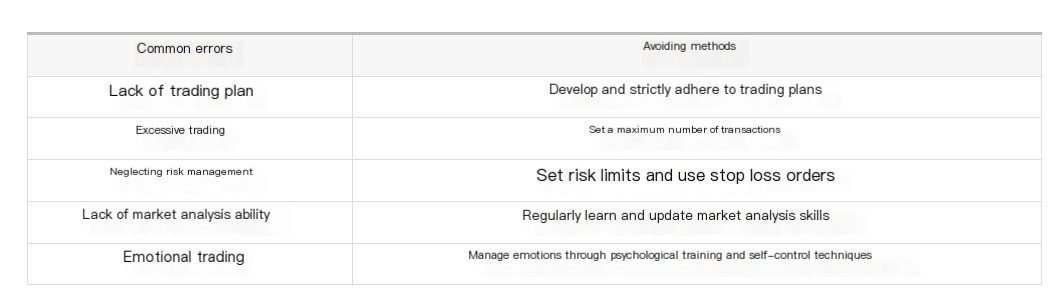

Here is a comparison table of some common trading errors and their avoidance methods:

By identifying and resolving these common trading errors, traders can significantly improve their trading success rate and stability. Continuous learning and self-improvement are key to maintaining competitiveness in the futures market.

Back

Back