As an important component of the agricultural futures market, corn futures not only reflect the dynamics of the global agricultural economy, but also have a profound impact on various links of the agricultural industry chain. In recent years, the corn futures market has shown several significant trends, which have a particularly significant impact on the agricultural industry.

Firstly, the price volatility in the corn futures market has increased. Due to the impact of global climate change, policy adjustments, and supply-demand relationships, corn futures prices have shown significant fluctuations. For example, extreme weather events such as droughts or floods may lead to a decrease in corn production, thereby driving up futures prices. This price fluctuation poses challenges for agricultural producers, processing enterprises, and consumers. Producers need to predict market trends more accurately to avoid risks, processing companies need to adjust their procurement strategies flexibly, and consumers may face rising food prices.

Secondly, the internationalization level of the corn futures market continues to improve. With the deepening of global trade, the corn futures market is increasingly influenced by the international market. For example, as the world's largest corn producer, the United States' corn futures prices have a significant impact on the global market. Changes in international trade policies, exchange rate fluctuations, and changes in supply and demand in the international market can all have an impact on corn futures prices. This internationalization trend has prompted the agricultural industry to pay more attention to the dynamics of the global market, enhancing the global competitiveness of the industry chain.

In addition, technological advancements in the corn futures market are constantly driving market development. The popularity of electronic trading platforms has made transactions more convenient and information more transparent. The application of high-frequency trading and algorithmic trading has made market reactions more rapid, but it has also increased the complexity of the market. The agricultural industry needs to adapt to this technological advancement and utilize advanced technological means for market analysis and risk management.

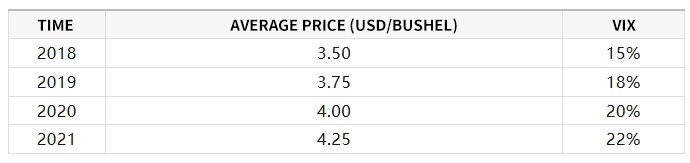

The following are some key data from the corn futures market in recent years, demonstrating changes in market trends:

From the table, it can be seen that the average price of corn futures has been increasing year by year, while the volatility is also increasing. The impact of this trend on the agricultural industry is multifaceted. Firstly, producers need to pay more attention to market dynamics and arrange planting plans reasonably to cope with the risks brought by price fluctuations. Secondly, processing enterprises need to establish a more flexible supply chain management system to cope with fluctuations in raw material prices. Finally, the government and relevant institutions need to formulate more effective policies to stabilize the market and ensure the sustainable development of the agricultural industry.

In short, the trend of the corn futures market has a comprehensive impact on the agricultural industry. Both producers, processing enterprises, and consumers need to closely monitor market dynamics and adopt corresponding strategies to cope with market changes. At the same time, the government and relevant institutions also need to play an active role in promoting the stable development of the agricultural industry through policy guidance and market regulation.

Back

Back