There are rumors in the domestic market that relevant government departments have held talks with multiple domestic grain import enterprises in Beijing to control the quantity of grain imports.

According to overseas media reports, China has requested traders to reduce imports of feed due to sufficient domestic supply and low demand expectations, which have put pressure on domestic grain prices. Insiders revealed that China convened a meeting with major grain importers this week and suggested stopping the purchase of barley and sorghum from abroad. With the expectation of a bumper grain harvest in China this year, this move aims to alleviate the pressure of domestic oversupply and boost domestic prices to protect farmers' income. Although there is currently no further public announcement regarding the rumors, imports will not be suddenly halted or dropped to a very low level. However, it is clear that the reduction in imports of grains such as wheat, corn, barley, and sorghum is expected to become a reality, and the key will depend on the strength of policy adjustments, which is the key factor affecting domestic grain prices. Earlier this year, due to an increase in domestic supply, the government requested traders to reduce corn imports. In recent years, the total grain output has reached new highs every year, but imports have also continued to reach new highs. Moderate imports of grain are an important means for China to adjust domestic surplus and shortage and stabilize grain prices. However, in the context of weak domestic grain demand, low-priced imports of foreign grain will further increase the pressure on domestic grain supply, drag down domestic grain prices, affect farmers' income from grain production, and have potential impacts on domestic food security. In 2023, corn storage in Northeast China will increase for the first time, and in 2024, wheat storage in major production areas will increase for the first time. However, currently, domestic prices of wheat, corn, sorghum, and barley are all close to the lowest level in over three years. China is the world's largest importer of barley and sorghum, and any sustained import restrictions will not only have a significant impact on the domestic grain market, but will also have a blow to major exporting countries such as Australia and the United States.

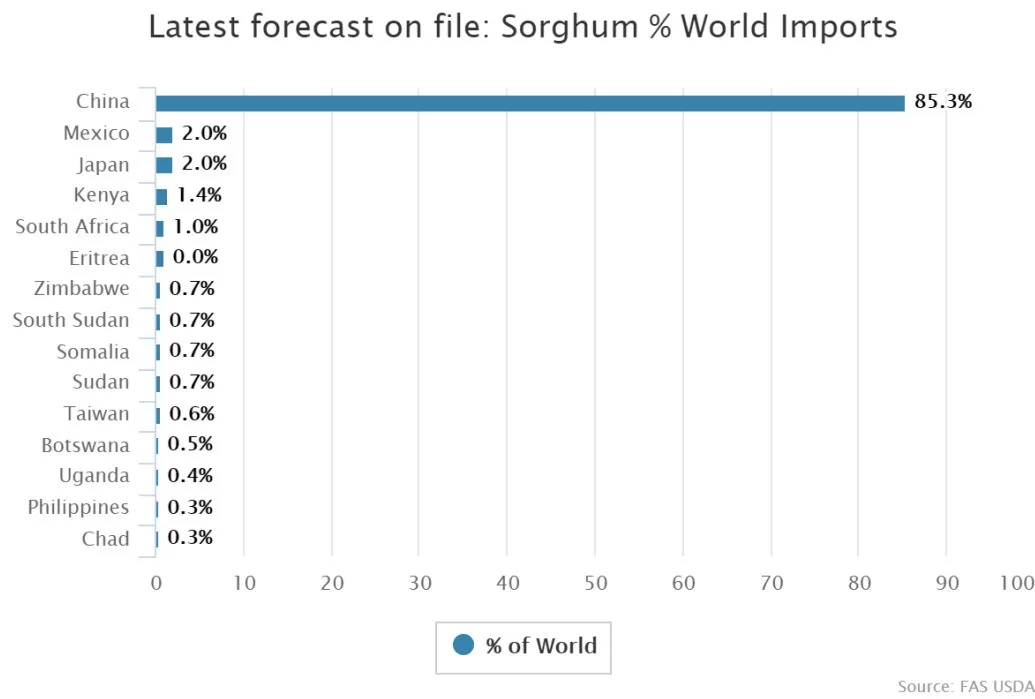

China's sorghum imports account for 85.3% of the global total

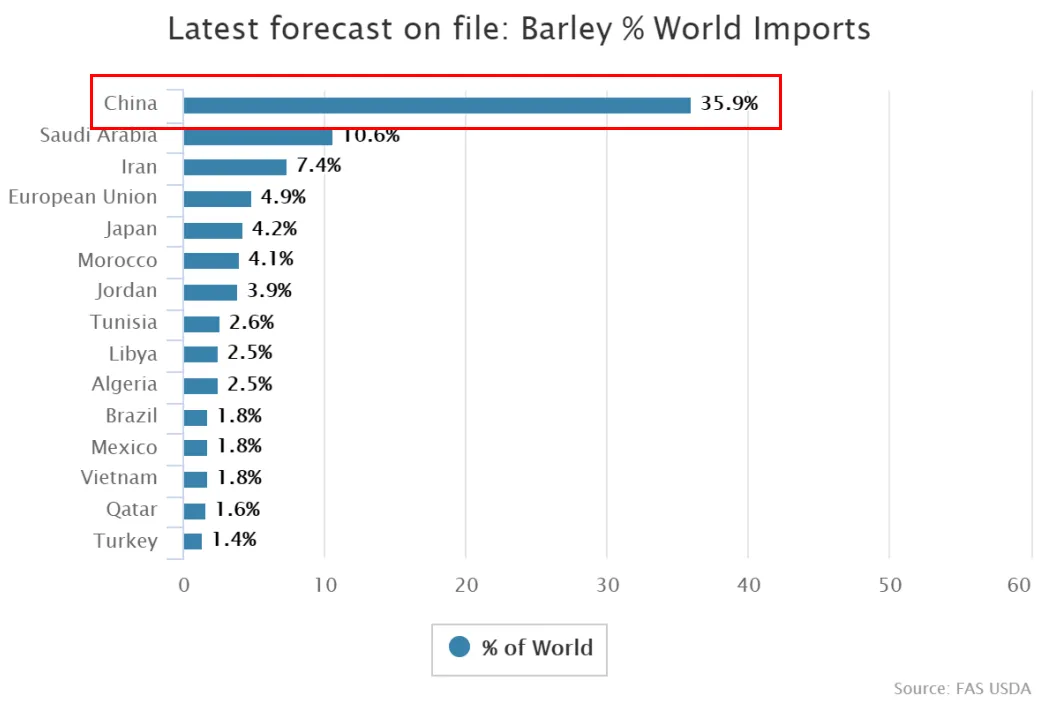

China's barley imports account for 35.9% of the global total

In recent years, the quantity of imported corn and its substitutes in China has remained at a historical high. At present, the corn inventory in southern ports of China is close to the highest level in two years. In the first seven months of 2024, China's sorghum imports amounted to 5.21 million tons, almost double the same period last year, including imports from the United States (4.32 million tons, accounting for 82.9%), Australia (720000 tons, 13.8%), and Argentina (170000 tons, 3.3%). During the same period, China imported 9.72 million tons of barley, an increase of 67.1% year-on-year. Most of it comes from Australia (4.094 million tons, accounting for 42%), as China had earlier lifted its ban on Australian barley. In addition, there are also sources from Argentina (1.37 million tons, 14%), France (1.25 million tons, 12.8%), and Canada (1.18 million tons, 12.2%). In order to prevent low-priced foreign grains from impacting the domestic market, China has implemented import tariff quota management for the three main grains of wheat, corn, and rice. The import quota for wheat is 9.636 million tons, corn is 7.2 million tons, and rice is 5.32 million tons, with a low tariff of 1% levied within the quota and a tariff of 65% levied outside the quota. However, since 2020, China's grain imports have significantly increased, with the three main grains of corn, wheat, and rice breaking through import quotas one after another.

As of the first seven months, the total import volume of wheat was 9.983 million tons, an increase of about 15% year-on-year, exceeding the quota by 347000 tons. In the next five months, it will be imported outside the quota, which is already the third consecutive year of exceeding the quota. Corn exceeded the quota even more fiercely, with a total import volume of 12.14 million tons in the first seven months, a year-on-year decrease of about 11.5%, exceeding the quota by 4.94 million tons, which is the fifth consecutive year of exceeding the quota. Rice is still imported within the quota. Due to global rice prices being higher than domestic rice prices, imported rice has lost its price advantage. In the first seven months, the import volume of rice was 805000 tons, a decrease of about 57% year-on-year, accounting for only 15% of the total quota. Only 6.15 million tons were imported in 2022, exceeding the quota, and now they have all fallen back within the quota level.

As a developing country, after China's entry into the WTO, the agricultural product market is generally limited. The tariff quota system has played a considerable role in China's agriculture in the international market competition. At present, the three major grain quotas are facing very prominent problems. Americans have always felt that the tariff quota should be increased or should be abandoned, but China has never done so in order to protect the development of domestic industries and protect the interests of farmers. China implements quota management for grain imports, but the post tax price of imported grain is still lower than domestic grain prices. It is difficult to reverse this trend solely through tariffs, and reducing grain production costs through large-scale operations is also difficult to achieve in the short term.

In the context of steady and increasing grain prices year after year, grain imports also have a certain impact on domestic grain prices. Experts believe that the starting point and foothold of grain imports is to ensure national food security at a higher level, and must comply with and serve the national food security strategy. We need to grasp both domestic and international markets and resources, effectively balance the import demand and domestic supply relationship, and prevent the large-scale import of low-priced grain from impacting the security of the domestic grain industry.

Back

Back