Because of its unique geographical location, Russia is a fortress in China's "the Belt and Road" strategy, which is a new "sweet cake" in the eyes of foreign traders.

In addition, in the past two years, Western brands have withdrawn from the Russian market, and Chinese large, medium, and small foreign trade enterprises have quickly filled their positions and occupied market share, resulting in rapid growth in Sino Russian trade volume.

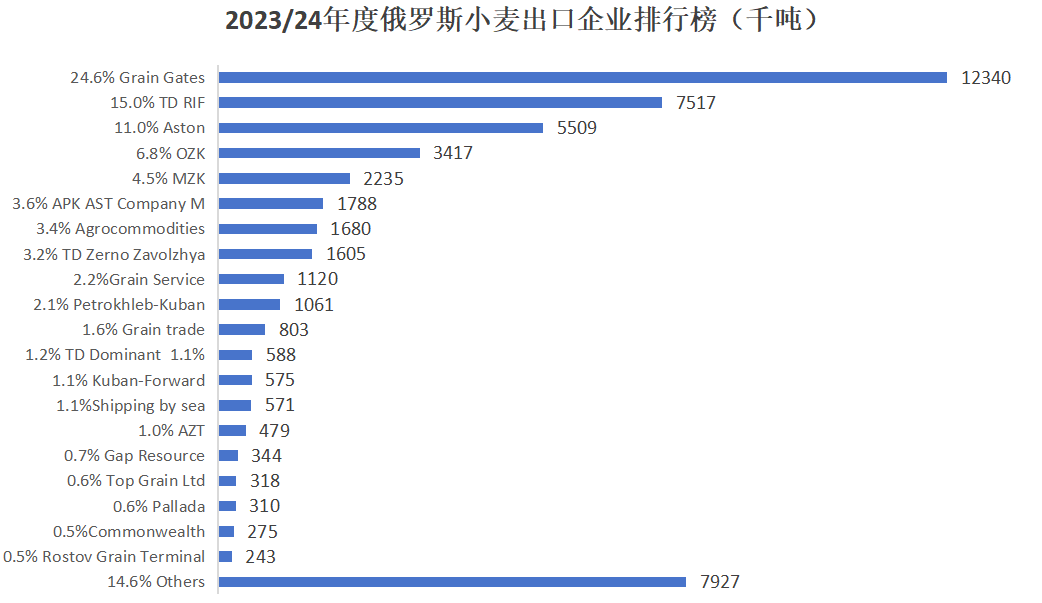

In terms of wheat, the export volume reached 50.7 million tons in 2023/24. The top 20 exporters exported a total of 42.778 million tons of wheat, accounting for 85.4% of the total export volume. Among them:

Grain Gates: Exported 12.34 million tons, accounting for 24.6% of the market share, ranking first.

TD RIF: Exported 7.517 million tons, accounting for 15% of the market share and ranking second.

Aston exports 5.509 million tons, accounting for 11% of the market share and ranking third.

The other 17 enterprises exported a total of 17.412 million tons, accounting for 34.8% of the market share.

In terms of barley exports, the export volume in 2021/22 was 6.1 million tons, while in 2022/23 it slightly decreased to 5.8 million tons. However, the export volume of barley rebounded to 7.676 million tons in 2023/24. Among them:

TD RIF: Exported 1.3128 million tons, accounting for 17.8% of the market share, ranking first.

Aston exports 1084400 tons, accounting for 14.8% of the market share and ranking second.

Grain Gates: exports 946200 tons, accounting for 12.9% of the market share, ranking third.

The other 17 enterprises exported a total of 2.6292 million tons, accounting for 35.8% of the market share.

Back

Back